Your Path to a Healthy Financial Future

This page is your gateway to financial wellness. Financial wellness is not just having a large bank balance but also having a positive relationship with money. We are dedicated to helping you achieve your financial goals and improve your economic well-being.

Our team will provide personalized solutions that will help you navigate the complex world of finance with ease and confidence.

We believe that financial wellness is a journey that goes beyond just the end result. This page is dedicated to enhancing awareness and equipping you with the tools to navigate life's challenges and make prudent financial decisions along the way.

We understand that each individual's financial situation is unique, and that's why we focus on providing guidance and support in three essential areas that can help you proactively shape your financial well-being.

Let us help you build a solid foundation for your financial wellness today with 3 Essential Pillars!

Your Path to a Healthy Financial Future

This page is your gateway to financial wellness. Financial wellness is not just having a large bank balance but also having a positive relationship with money. We are dedicated to helping you achieve your financial goals and improve your economic well-being.

Our team will provide personalized solutions that will help you navigate the complex world of finance with ease and confidence.

We believe that financial wellness is a journey that goes beyond just the end result. This page is dedicated to enhancing awareness and equipping you with the tools to navigate life's challenges and make prudent financial decisions along the way.

We understand that each individual's financial situation is unique, and that's why we focus on providing guidance and support in three essential areas that can help you proactively shape your financial well-being.

Let us help you build a solid foundation for your financial wellness today with 3 Essential Pillars!

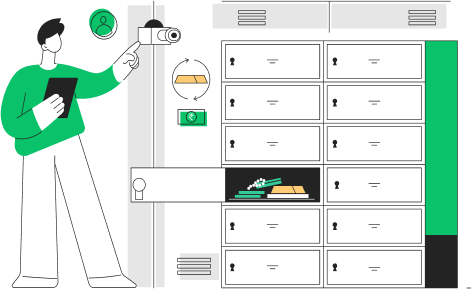

1. Setting Up Your Financial Locker

Organize and Secure Your Financial Information on the go!

Sharing financial information with your loved ones is crucial for their peace of mind and security. At JRG Financials, we understand the significance of open communication and transparency within families.

A single document containing important financial details and information can serve as a Financial Locker which can be a shared with your trusted family members. By keeping everyone informed about your assets and financial position, you ensure that your loved ones are prepared for any uncertainty that may arise.

Let us help you strengthen your family's financial well-being by facilitating meaningful conversations and providing a platform for shared financial knowledge and security.

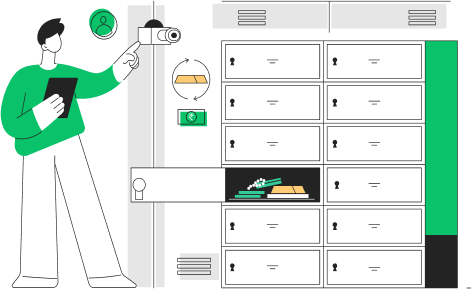

1. Setting Up Your Financial Locker

Organize and Secure Your Financial Information on the go!

Sharing financial information with your loved ones is crucial for their peace of mind and security. At JRG Financials, we understand the significance of open communication and transparency within families.

A single document containing important financial details and information can serve as a Financial Locker which can be a shared with your trusted family members. By keeping everyone informed about your assets and financial position, you ensure that your loved ones are prepared for any uncertainty that may arise.

Let us help you strengthen your family's financial well-being by facilitating meaningful conversations and providing a platform for shared financial knowledge and security.

2. Assess Your Financial Fitness

Make your first step towards Financial Wellbeing with our comprehensive Step-by-Step Checklist. Ensure a Secure Future by Checking Off 12 Financial Milestones. But why?

Here’s How It Helps!

Setting Financial Goals

Identify your financial objectives with specific numbers and timelines to create a roadmap for achieving them.

Creating a Budget

Know your monthly and annual expenses and stick to a budgeted expenditure plan to help you save and invest regularly.

Investing with Purpose

Channelize your savings into investments that align with your financial goals, instead of letting them lie idle in a bank account.

Protecting Your Assets

Ensure you have adequate insurance coverage to secure your financial future and protect your loved ones.

3. Discover Your Risk Profile

Get an Insight into Your Investment Personality with our Risk Profiler

We understand that investing can be daunting, so we're here to help you make informed decisions based on your risk profile. Our risk profiler is designed to help you understand your investment personality and allocate your assets accordingly. Whether you're a conservative investor who prefers low-risk investments or an aggressive investor willing to take risks for higher returns, our profiler will guide you in the right direction. Let us help you achieve your financial goals and take the first step towards a more secure financial future.

3. Discover Your Risk Profile

Get an Insight into Your Investment Personality with our Risk Profiler

We understand that investing can be daunting, so we're here to help you make informed decisions based on your risk profile. Our risk profiler is designed to help you understand your investment personality and allocate your assets accordingly. Whether you're a conservative investor who prefers low-risk investments or an aggressive investor willing to take risks for higher returns, our profiler will guide you in the right direction. Let us help you achieve your financial goals and take the first step towards a more secure financial future.

Take control of your financial well-being today!

Contact JRG Financials for a personalized evaluation and embark on a journey toward a brighter financial future. Your well-being is our priority.

Contact us now and let's start your journey to financial success.