What is Financial Planning

“The future you see is the future you get” — Robert Allen

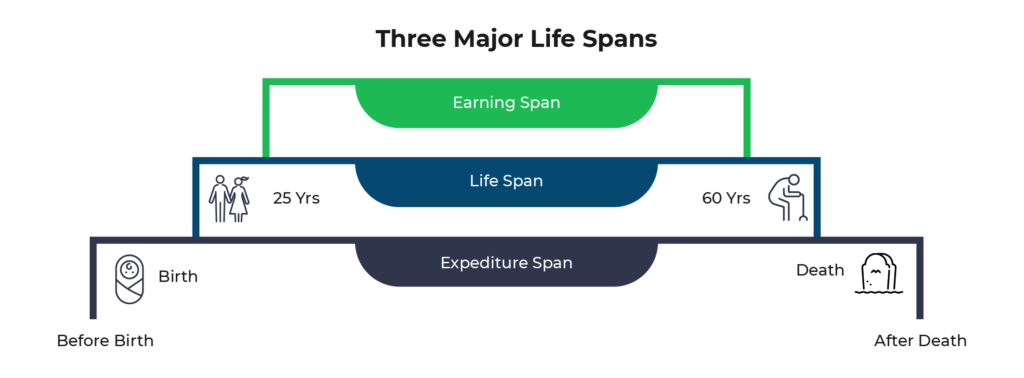

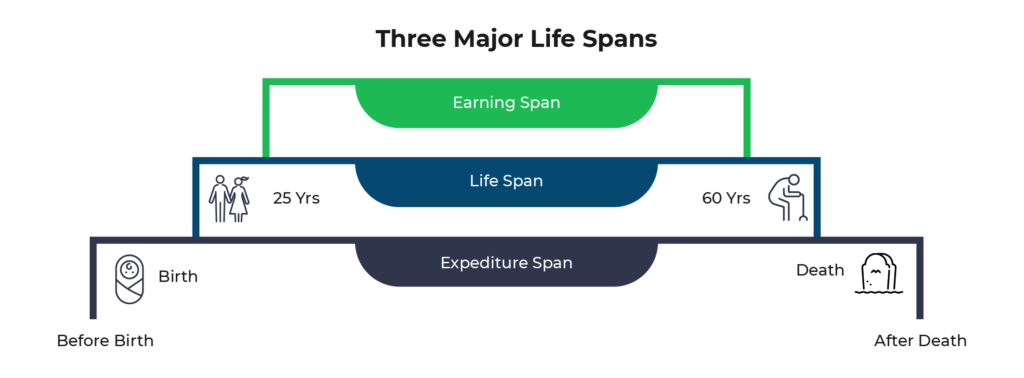

Humans have three spans or phases in their life. Shortest is the earning span. Life span is the period from birth till death. Longest is the expenditure span: starting before birth and extending after death.

We need to plan to cover the gap between expenditure and earning spans. Hence, during the earning span it is imperative to save and invest our savings strategically to meet your life goals. This is Financial Planning.

This strategy during the earning phase enables us to meet our expenses and maintain our standard of living life long. It helps to understand how much money you will need at different stages of life and how to save opting best investment options. Thus optimizing our scarce resources to gain financial security and achieve life goals.

Importance of Financial Planning

The two most important pillars for a good financial plan are-

Investment Planning

We provide the strategy to accomplish your financial goals like retirement, children’s education and marriage. Considering your investment objectives and risk tolerance an investment plan is tailor made.

We review the investment plan periodically to update and achieve optimum asset allocation. To make your investment plan most efficient, we focus on the following:-

• Long-Term Wealth Creation: Secure a steady income in retirement through tailored strategies.

• Financial Discipline: Achieve success with disciplined saving, spending, and investing.

• Holistic Financial Planning: Prioritize Retirement, Investment, Tax, and Contingency Planning.

We believe in goal-based investment planning which is as follows:

We provide the strategy to accomplish your financial goals like retirement, children’s education and marriage. Considering your investment objectives and risk tolerance an investment plan is tailor made.

We review the investment plan periodically to update and achieve optimum asset allocation. To make your investment plan most efficient, we focus on the following:-

• Long-Term Wealth Creation: Secure a steady income in retirement through tailored strategies.

• Financial Discipline: Achieve success with disciplined saving, spending, and investing.

• Holistic Financial Planning: Prioritize Retirement, Investment, Tax, and Contingency Planning.

We believe in goal-based investment planning which is as follows:

Why is Financial Planner important?

GPS and a fuel indicator in our car help us in planning our journey in a scientifically optimal manner. A best financial planner plays the same role in our journey of financial planning and growth. He devises strategies best designed to achieve the financial growth of the customer. Best financial planner keeps in mind various factors like resources, age and risk profile of the client, modifying these strategies from time to time, if required. He handles the client’s emotional swings in response to the market movements. Thus, investment becomes a systemic activity banishing impulse and emotion to achieve a balance between fear and greed.

“Let our advance thinking become your advance planning”.

We listen closely and take the time to understand your complete financial picture — your cash, liabilities, risk protection, investments and taxes. Through our personal approach to financial planning and advice, we can help you match your aspirations with reality. We aim to provide the right direction for the best low-risk returns.

Every parent wants his or her child to get the very best in life. Good education is expensive and the costs will only continue to rise. Therefore, it is necessary to carefully plan your child’s education fund and be ready with the right amount of money as and when required instead of being bogged down by the high costs of education.

Every parent wants his or her child to get the very best in life. Good education is expensive and the costs will only continue to rise. Therefore, it is necessary to carefully plan your child’s education fund and be ready with the right amount of money as and when required instead of being bogged down by the high costs of education. A child’s wedding is one of the most important events of a parent’s life. Many of us want to host a dream wedding to mark a new beginning in our child’s life. Wedding expenses are a major financial goal. Though the exact time span available and expenses can’t be ascertained to perfection, one can always plan and create a fund that can support future wedding expenses.

A child’s wedding is one of the most important events of a parent’s life. Many of us want to host a dream wedding to mark a new beginning in our child’s life. Wedding expenses are a major financial goal. Though the exact time span available and expenses can’t be ascertained to perfection, one can always plan and create a fund that can support future wedding expenses.

The ability to catch up on all unfulfilled desires is our vision for life after retirement. As life goes on, due to a shortage of time and resources we delay gratification of our desires. This gets more difficult with the passage of time as the cost of living keeps rising along with the standard of living.

The ability to catch up on all unfulfilled desires is our vision for life after retirement. As life goes on, due to a shortage of time and resources we delay gratification of our desires. This gets more difficult with the passage of time as the cost of living keeps rising along with the standard of living.

Professional financial planning, including retirement planning services in India, shapes your dreams into reality. Advanced medical science has increased the normal life span, and the number of years a person spends in his working life is approximately equivalent to the number of years in his retired life.

Research has shown that in India, the majority of the elderly are forced to lead miserable lives due to a lack of liquidity. Since most of their wealth is locked in illiquid assets like real estate.

Planning for retirement and retirement advisor and planning services in India shouldn’t be postponed until a later date. The tree of wealth creation planted during the earning phase gets ample time for growth and bears fruit in the retirement phase.

Why we need an adequate retirement corpus?

- Enables us to realize unfulfilled desires.

- Maintain our standard of living.

- Provide for Contingencies.

- Preserves our dignity and independence.

- Ensures peaceful life after retirement.

Why people are unable to retire?

- Income is reduced

- Increasing expenditure due to increasing cost of living

- Unexpected expenses

- Using Retirement funds Prematurely to handle contingencies

- Outstanding Liabilities

- Pending Responsibilities

- Inadequate Retirement provision

Here are some aspects of life, where you need a financial planner:-

- To protect yourself and your loved ones from financial uncertainties.

- Financial planning for child education.

- To plan and achieve your financial goals.

- To build up an adequate corpus in the long term.

- To retire with pride as and when you want.

- Financial planning for women.

How can we help?

JRG ensures that “our plans & your goals work in tandem to make your dreams come true”

It is nearly impossible for one to sift through the numerous investment products available in the market. At JRG, we understand the importance of listening & understanding your current scenario and detailing your future goals, Therefore aim to be best financial planner in Gurgaon. This is the most important step in creating a bespoke financial plan for you. We help you create, preserve and manage wealth in the long term. The optimal financial plan is customized with our core inputs.

Financial Pyramid

The most stable and infallible structure which has withstood the test of time is the pyramid.

Our top most priority is to protect future earnings of the bread winner. Death affects the family emotionally and financially. The emotional loss gets compounded if future earnings are not protected. This is the foundation of our financial pyramid.

After protection, comes investment. Gradually, we move investment from risk free growth to high growth with higher risk investment as per client profile. We suggest small amount of investible surplus in higher risk investment products at the top of our financial pyramid.

We at JRG, structure financial planning in such a way that the client has

How can we help?

JRG ensures that “our plans & your goals work in tandem to make your dreams come true”

It is nearly impossible for one to sift through the numerous investment products available in the market. At JRG, we understand the importance of listening to & understanding your current scenario and detailing your future goals. This is the most important step in creating a bespoke financial plan for you. We help you create, preserve and manage wealth in the long term. The optimal financial plan is customized with our core inputs.

Financial Pyramid

The most stable and infallible structure which has withstood the test of time is the pyramid.

Our top most priority is to protect future earnings of the bread winner. Death affects the family emotionally and financially. The emotional loss gets compounded if future earnings are not protected. This is the foundation of our financial pyramid.

After protection, comes investment. Gradually, we move investment from risk free growth to high growth with higher risk investment as per client profile. We suggest small amount of investible surplus in higher risk investment products at the top of our financial pyramid.

We at JRG, structure financial planning in such a way that the client has

Why Choose JRG Financial for a Stress-Free Financial Future

Imagine a future where you can live on your own terms and financial worries no longer hold you back. Picture yourself achieving your goals, whether buying a dream home, traveling the world, or securing a comfortable retirement with the best retirement planning company in Gurgaon.

What if you could make informed decisions aligning with your values and aspirations, knowing you're on the right path? At JRG Financials, we're here to guide you toward your stress-free financial future with our All-Inclusive Financial Roadmap.

Personalised Approach

Financial planning isn't just about numbers and charts; it's about you. We want to know what keeps you up at night and what excites you about the future, your aspirations and the obstacles standing in your way. We can create a plan uniquely tailored to you by truly understanding your desires and concerns.

Setting Clear Goals

Imagine the satisfaction of achieving specific objectives within a year or less. Whether saving for that much-needed vacation, paying off a nagging credit card debt, or building an emergency fund, setting goals to provide a sense of accomplishment and immediate impact. They act as stepping stones on your path to financial success, motivating you to keep pushing forward.

Financial Evaluation

Have you ever wondered where your hard-earned money goes? Are you curious about your overall financial health? At JRG Financials, understanding your current financial situation is crucial for building a solid foundation for your future. Let's dive into the process of evaluating your economic landscape and discover how it can empower you to make informed decisions.

Financial Awareness

We aim to demystify financial concepts through personalized guidance, workshops, and educational materials, from budgeting and investing to understanding insurance and retirement planning. By arming you with the correct information, we empower you to make sound financial decisions that align with your goals.